Fast Track Blog

5 Best Books Helped Me Understand Investing and Build an Investment Portfolio

Photo by Priscilla Du Preez on Unsplash

The reason that pushed me to learn how to invest myself is an incident with a financial advisor, with whom I had a bad experience. You can read this article <My ‘Rich’ Journey With A Financial Advisor — Mistakes You Should Avoid>, maybe it will help you to avoid some mistakes I made.

In short, I learned the lesson that with or without a financial advisor, I need to understand where my money goes, what are the consequences I should expect, worst, average, or best. Then it won’t be a big ‘surprise’ to me when I need to use the money.

Here is the step by step read if you are a beginner.

1. Rich Dad Poor Dad

What can I say, it is the basic of the basics. The book is written in such a simple language that even a primary student can read it. I do, however, recommend any primary student to start reading this book and get some financial education. The key messages in the book are:

-

Why rich people don’t work for money

-

The importance of learning personal finance

-

Focus on your career

-

the power of tax optimization and company

-

investing

-

learn to use your money to make money

Many people might have some misconceptions about investing, even resist the idea from their own experience or influence from others. Have an open mind to read this book and if you understand the principles, it will naturally make sense to you. One important concept is the cashflow quadrant. It is easy to understand, but from understanding to belief, there is a big step to take.

You see, it is clear that when you are in the I quadrant, you have the most income potential and you don’t need to sell your time. When you are in the E quadrant, you sell your time for money. When you have a company, you are in the B quadrant, your employees are your leverage. How many people saw this chart and then take action to the I? Not everyone. Maybe you are one of the few. Because from understand to belief to action, it is not a straight line.

But by reading this book, you start with understanding, better than doing nothing. So after you finish this book, I will introduce a rather thick book to you.

2. Money — Master The Game: 7 Simple Steps To Financial Freedom

Tony Robbins writes this book, he has few other books about money, but I personally want to recommend this one. Why? Because it is very comprehensive. That is why it is not a small book. It talked about your financial goals, how to go from step by step to increase your financial situation, tax optimization, working with a financial advisor, different investment products, retirements… Mistakes you should avoid, success stories from others, investment portfolios recommended by famous investors. Many examples are supported by facts and graphs, you then have a quick understanding of why things are how they are.

Even though this book is very much US-reader-oriented, you can still learn a lot from it. The basic principles are the same. Many investment products are also available in other countries with some differences. Please don’t replicate everything, think yourself, and decide on how you want to plan your financial future.

After you finish reading this book, you will have a good understanding of many other detailed concepts about investing and financial planning.

Then you can read the next book to get started with investing.

3. The Bogelheads’ Guide To Investing

Please read this book before you put any money into the stock market! The major misconception about investing is that many people think it is about to buy low sell high — trading. It is not. When you are not an experienced trader or a professional, you most likely lose money than make money if you try the ‘buy low sell high’ strategy.

This book explains to you what is your financial lifestyle, what are the basics of investing, what are bonds, stocks, mutual funds, ETFs. How you should invest. How to use the tax-saving accounts. Asset allocation. How to lower your fees. The hazards of market chasing and try to time the markets. There is a lot more valuable information in this book. Again, it is for US readers, but some apply in other countries too. For example tax-saving retirement accounts, same indexing ETFs in your currency, etc.

This book teaches an average investor (not professional) the right mindset towards investing. After reading the book, you have built solid ground.

Again, please read this book before you start investing!

4. The Millionaire Next Door

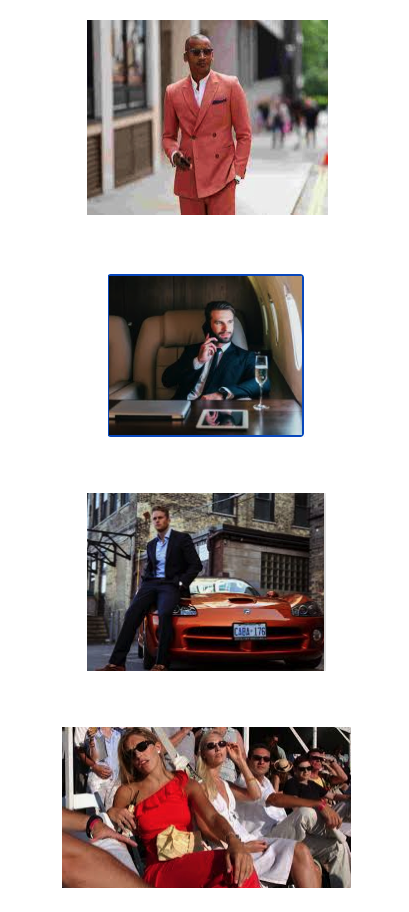

This book is not purely about investing, but I include it here because how you treat your money, decides how you build wealth, not just from investment. Thomas J. Stanley and William D. Danko have conducted extensive research on the millionaires in the US. The findings in the book will shock many people. If you google image millionaires, you will find:

You get what I mean. People associate it with a luxury lifestyle, expensive cars, a big townhouse, and fancy parties. Those are the typical images, even though a million-dollar worth less than in the 90s, the research still proves a strong point.

The majority of America’s millionaires live in middle-class neighborhoods, drive a second-hand mid-range car, wears watches that cost no more than a few hundred dollars.

The most popular watch by millionaires? Seiko

The most popular car by millionaires? Ford F-150 pickup

Most expensive suit ever purchased? 50% of them answered less than $399.

Pair of shoes? $140

Wristwatch? $235

The book teaches you, wealth is not what you show, is what you keep. It is really worth reading. Because investing is about making more money, this book teaches you how to orient your lifestyle in line with your values, and save more. then you can invest more.

Are you ready for a complete mind-opening experience? Here comes the last book I recommend:

5. Your Money Or Your Life

What is your goal with investing? I think it is to use the money to provide you with a life that you enjoy living, right? Eventually, money is just a tool, it is a means to an end, not the end itself. Here is the problem of the triangle that most of us struggle with:

When you are young, you have health, but you don’t have money and you are working hard to earn money so you don’t have time for yourself.

When you are at mid-age, you might have more money, but you have less health and also not enough time for yourself.

When you are old, you have time, you might not have the body to enjoy life, hopefully, you have enough money saved and invested for old years.

In none of the scenarios, we can have all three of them? Is it so? Maybe it is the way how we look at ourselves that constrains the possibilities to have them all.

We look at our hourly rate as income, but the real income is only half of that. You can read my other article <Why Your Real Hourly Rate Is Only Less Than 50% of What You Are Paid>. Then you have to think about, is it worth to have those expenses that lower your hourly rate? Maybe some of them are not worth it. And instead, you can save and invest for your future. When you do the math and take action, you might even be able to retire 10 years earlier or more. This book transforms your relationship with money and really helps you to understand how you can use money as an effective tool to achieve financial independence. One of the ways is through investing. But investing is not a standalone action, it services a purpose to pursue your desired lifestyle. That is why I include this book in the investing book recommendations.

If you read all those 5 books, I am 100% sure that it will transform your relationship with money and you know how to invest and what kind of financial future you will have. Then you just have peace and take the baby steps to achieve your goals.

Leave me a comment after you finish reading them, what do you think?

Do you have other books to recommend? Please write in the comments below.

Related article <Why You Are Afraid of Investing and Can Never Be Rich>.

If you want to find out more about how you can improve your personal wealth. Subscribe to the newsletter for more content on the topic of personal finance, helping you to launch your life on the Fast Track.

Share this post

Latest Blog Posts

Money Mindset

January Expense for a Family of 2 in Switzerland

Read MoreMoney

The Cost of Having a Baby in Switzerland

Read MorePersonal Finance

3 Things You Need To Know Before Buying a Property in Switzerland

Read More